Understanding and Utilizing Cryptocurrencies in Iran

by Ehsan

Cryptocurrencies, a digital or virtual form of currency, utilize cryptography for security purposes. Prominent examples include Bitcoin, Ethereum, and Ripple. The backbone technology, known as blockchain, ensures decentralized control as opposed to centralized digital currency and central banking systems.

- Bitcoin, invented in 2008, introduced the concept of cryptocurrencies and remains the most valuable and popular.

- Ethereum, launched in 2015, introduced smart contracts and decentralized applications (DApps).

- Ripple, developed in 2012, aims to facilitate fast, low-cost international money transfers.

Blockchain technology promotes transparency, traceability, and reduced transaction costs. These properties make it highly attractive for record-keeping activities beyond just financial transactions.

The Legal Position and Utilization of Cryptocurrencies in Iran

The legal status of cryptocurrencies in Iran is intricate and dynamic. In recent years, Iran has been both receptive and restrictive towards cryptocurrency usage. The government, initially banning all forms of cryptocurrency transactions in 2018, reversed the policy in 2019 to regulate and allow mining operations as an experimental economic measure.

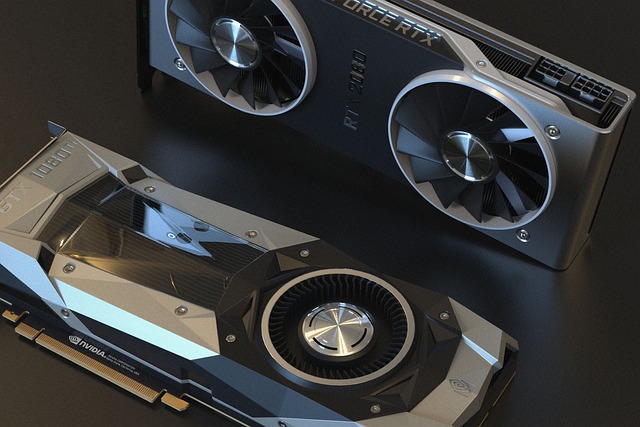

- Mining operations: Authorized as an industrial activity, mining farms must be licensed by Iran's Ministry of Industry, Mine and Trade.

- Power consumption: Cryptocurrency miners must adhere to heavy tariffs for electricity, to prevent overuse of the national grid.

- Use for imports: In a novel approach to circumvent sanctions, Iran's Central Bank permits use of legally mined cryptocurrencies for funding imports.

Investment in Cryptocurrencies: Balancing Risks and Rewards

Investing in cryptocurrencies is a delicate balancing act between potential high returns and considerable risks. As a market still in its infancy in Iran, the following points should be considered before investing:

- Volatility:

The value of cryptocurrencies can fluctuate wildly. This volatility can bring both significant gains and losses. - Lack of regulation: While mining is regulated, other activities like trading and transactions are not well-regulated, posing a risk to investors.

- Potential rewards: Despite these risks, the potential for high returns is attractive to many. Bitcoin, for example, has seen substantial growth since its inception.

Top 3 Cryptocurrencies in Iran

| Cryptocurrency | Advantages | Risks |

|---|---|---|

| Bitcoin | Widely accepted, Strong historical performance | Highly volatile, Potential for regulatory crackdown |

| Ethereum | Technological versatility (Smart Contracts, DApps) | Less established than Bitcoin, Scaling challenges |

| Ripple | Low transaction fees, Fast transfers | Less decentralized, Uncertain regulatory status |

To effectively utilize cryptocurrencies in Iran, individuals and businesses need to be informed about their legal status, understand the underlying blockchain technology, and assess the risks and rewards of investing. As the country's cryptocurrency framework evolves, so too will the opportunities it presents.